The

Long(er) View in 2014

When making any decisions about the

future, one needs to look at long term trends, medium term episodes

and short term events. They all guide where we are likely to be in a

few years/ decades. Also, important is to understand the trends that

will happen no matter what, and other things that will seek to

counter-balance or reinforce these trends. In many cases, unraveling

of some trends will set off domino effects that will fundamentally

alter the reality that we see.

Overall trends can be assessed in the

following areas.

- Demographics

- Technology

- Science

- Energy

- Economy

- Social

- Politics

Out of the above, I would rate

Demographic trends to be most fundamental. Science and Technology

follow a close second. The remaining – Economic, Social and

Political trends to me are generated out of the more fundamental

forces that are likely to be more kosher.

Demographic trends in the next decade

The demographic trends in the near

future is almost clear. With 2.5 out of the 7 billion people on the

planet (37%) living in China and India, the world's population is

becoming more skewed towards South East Asia.

A more fair comparison would be the density of population.

Also, if we compared the population in East and South East Asia, we would find them to be comparable.

For most of the world population (including China), fertility rate is 1-2 births per woman. Also, world population growth rates around the world hover from -ve to 1-2% in most of the planet. So, what does all this mean?

|

| Global Population by country in 2013 |

|

| Global Population Density |

Also, if we compared the population in East and South East Asia, we would find them to be comparable.

For most of the world population (including China), fertility rate is 1-2 births per woman. Also, world population growth rates around the world hover from -ve to 1-2% in most of the planet. So, what does all this mean?

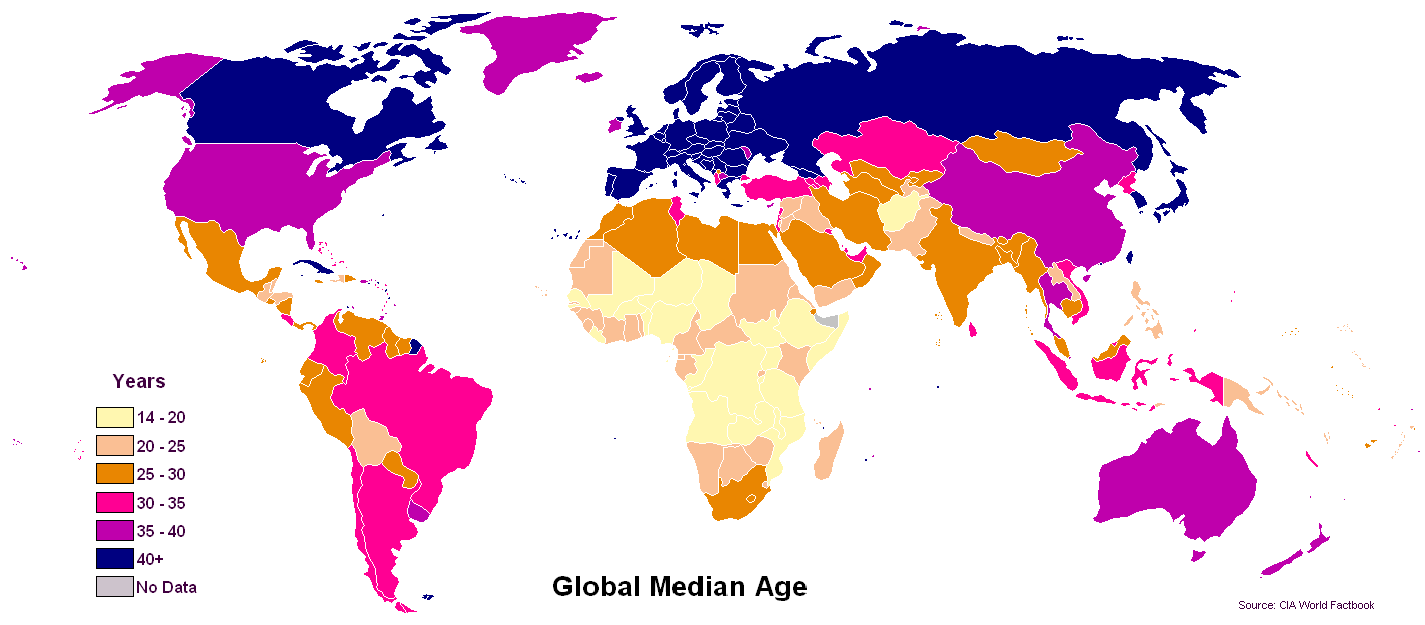

Next the median age in different countries of the world.

It means that there will be more older people in richer parts of the world, while more working/ younger population in poorer parts of the world. While a small percentage of the working population may choose to take care of the old and rich, it is more likely that the now older and retiring population would want the younger population to take care of them. This could happen through the following ways

- Healthcare professions may become more lucrative for younger population

- More automation and technology coming into healthcare

- More investment into training and education of younger people in health and medical disciplines.

- Establishment of large healthcare organizations that may provide direct employment opportunities to working populations in current countries.

- Manufacturing and innovation moving to more populous countries in Asia and Africa

- It will also be important for currencies to stay favourable for enticing younger populations to focus overseas.

If we see global expenditures on health

as percentage of GDP, we can see the following trend.

|

| Health Expenditure as a percentage of GDP by country matches the median age distribution shown above with some minor variations |

Technology Trends

Technology is disrupting the economics

of many fundamental value chains. Steve Jobs idea of modeling Apple

on Sony instead of Microsoft, upon his return to Apple, and then

using technology to try and disrupt each and every industry Sony was

in (almost), including music, media and entertainment is a case in

point.

As technology evolves, the threshold

economics of many traditional industries will give way. Industries

such as Banking (online banking), Trading (online), Finance, Higher

education (MOOCS), Insurance (Geico), Entertainment (Netflix and

YouTube), Print Media (websites, Facebook, declining advertising and

readership), etc. have already felt the tectonic plates shift with

communication and Internet technology. As new platforms emerge, they

unravel the economics of previous business models and allow new

businesses to emerge.

Mobile

New changes will likely be increased

adoption of 3G and 4G technologies in mobile. Current adoption is 30%

in markets where 3G is deployed, and 4G deployment is accelerating as

people are accessing more online services on their mobile. It is

likely in next few years, 3G and 4G adoption will grow substantially.

This is more true for areas where no other competing technologies

such as television and fixed line phones and Internet have been

deployed.

Also, as the mobile phone batteries

improve, processing improves and demand for gaming and media

consumption on mobile increases, it is likely that the phones will

become bigger and adoption of smart phones will increase. Also, as TV

content becomes more accessible on smart phones, it is likely that

the smart phone user base will grow beyond urban to more broad-based

as for traditional Television audience.

|

| Smartphone adoption will rise across all countries with additional services coming on line. |

Automobile Technology

Automobile technologies are increasing

range and reducing price of electric vehicles. Tesla motors seems to

be eying a more sizable percentage of the market in coming years, and

other vendors are also investing in making traditional combustion

engines, hybrids and electric vehicles more economic in terms of cost

of ownership. Pure electric cars now provide a range of 300 miles at

a full charge that costs 9 dollars on average.

In other countries, which are not producing their own oil (and hence have to rely largely on oil imports), the move to mass transit modes will intensify specially in urban areas. Given congestion and cost for travel, it is also likely that electronic commerce and e-delivery will intensify. In some countries, where the logistics and distribution is not well developed, online retailers may partner with brick and mortar companies to promote last mile delivery. Given these scenarios, it is likely that mobile commerce will also intensify.

In other countries, which are not producing their own oil (and hence have to rely largely on oil imports), the move to mass transit modes will intensify specially in urban areas. Given congestion and cost for travel, it is also likely that electronic commerce and e-delivery will intensify. In some countries, where the logistics and distribution is not well developed, online retailers may partner with brick and mortar companies to promote last mile delivery. Given these scenarios, it is likely that mobile commerce will also intensify.

Internet

There is wide disparity between

countries in terms of per capita bandwidth consumption. This is an

image from 2003, however this is perhaps indicative of the order of magnitude.

Given the economic realities that

underpin these innovations, it seems most likely that these

innovations will intensify. In the short and medium term, companies

will benefit from capital investment in last mile connectivity.

Science trends

Much of scientific research is focused

on medicine and health. This is a space I need to do more research to

understand the trends a little deeper.

Energy Trends

Energy trends are a little mixed at

this point. The ongoing exploration and extraction of oil and gas in

continental North America and in Russia is likely to put pressure on

OPEC. However, these efforts need oil to stay above 80 to 100 dollars

per barrel. Therefore, it is unlikely that price of oil is going to

change even with US and Europe reducing their reliance on middle

eastern oil. This will make alternative energy sources more appealing

including solar, wind and others. Also, as the adoption of electric

vehicles increases, it is likely that solar adoption will increase

both at grid as well as consumer side. On the consumer side, we can

expect households, offices, plugin charging stations increase their

adoption of solar and other alternative forms of energy.

Given new alternative forms of energy

sources coming online, it is anticipated that power grids will be

re-balanced to allow grids to tap into new forms of energy.

Initiatives such as Smart grid roll outs will see investments in

digitization and improvement in reliability of the grid. Smart grid

drivers seem to be of two kinds – firstly, introducing Demand

Responsive capabilities and secondly, Supply Responsive capabilities.

Given energy efficiency is improving across most usage scenarios

coupled with Time of use pricing, it is likely that Supply Responsive

measures will be a bigger driver for change to the Grids.

That now leaves Economy, Social and

Political trends that we will cover in the next post.